What is Crypto Arbitrage Trading?

Crypto arbitrage trading is a strategy used in the cryptocurrency market to exploit price differences of the same cryptocurrency on different exchanges. It involves buying the cryptocurrency on one exchange where the price is lower and simultaneously selling it on another exchange where the price is higher.

The trader profits from the price gap, taking advantage of market inefficiencies. Arbitrage opportunities can arise due to variations in supply and demand, trading volumes, or delays in price adjustments between exchanges. Automated trading bots are often used to execute arbitrage trades quickly, as manual execution can be too slow to capture fleeting price differentials.

However, it’s essential to consider transaction costs, withdrawal fees, and the time it takes to transfer funds between exchanges, as these factors can impact the profitability of arbitrage trading. Overall, crypto arbitrage trading seeks to capitalize on price differentials in a fast-moving and volatile market.

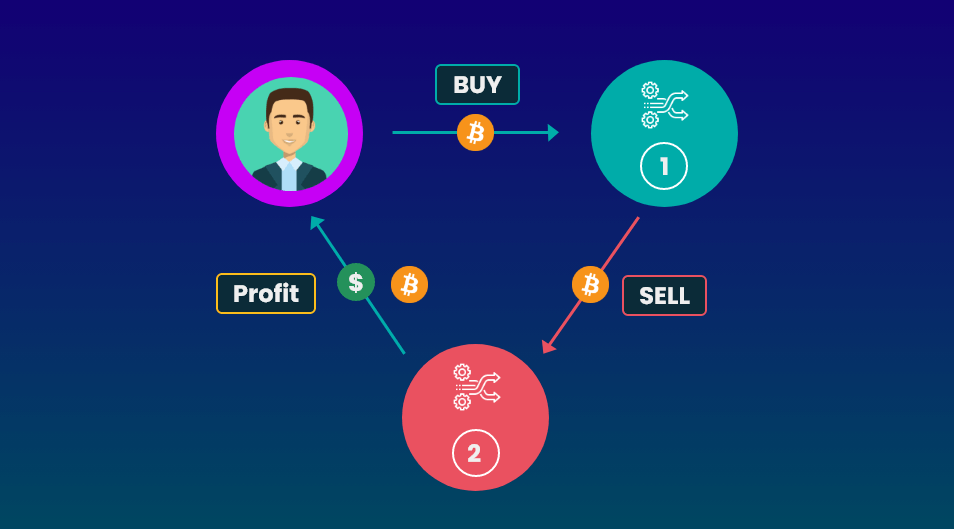

How Does Crypto Arbitrage Trading Work?

Crypto arbitrage trading is a strategy that takes advantage of price variations of the same cryptocurrency across different exchanges. Traders constantly monitor various cryptocurrency exchanges, looking for disparities in prices due to factors like trading volumes, market inefficiencies, or differences in supply and demand.

When an arbitrage opportunity is identified, the trader takes action. They purchase the cryptocurrency on the exchange where the price is lower, using their funds on that particular platform. Subsequently, they swiftly transfer the acquired cryptocurrency to the exchange where the price is higher.

This transfer may involve various cryptocurrencies or stablecoins to expedite the process. Once the cryptocurrency reaches the second exchange, the trader sells it at a higher price, ideally making a profit from the price difference. Automated trading bots are often used to execute these trades quickly, given the time-sensitive nature of arbitrage opportunities.

However, it’s crucial to consider transaction costs, withdrawal fees, and the time required for fund transfers, as these factors can affect the profitability of crypto arbitrage trading. In essence, crypto arbitrage trading capitalizes on market inefficiencies and fleeting price differences in the fast-paced and volatile cryptocurrency market.

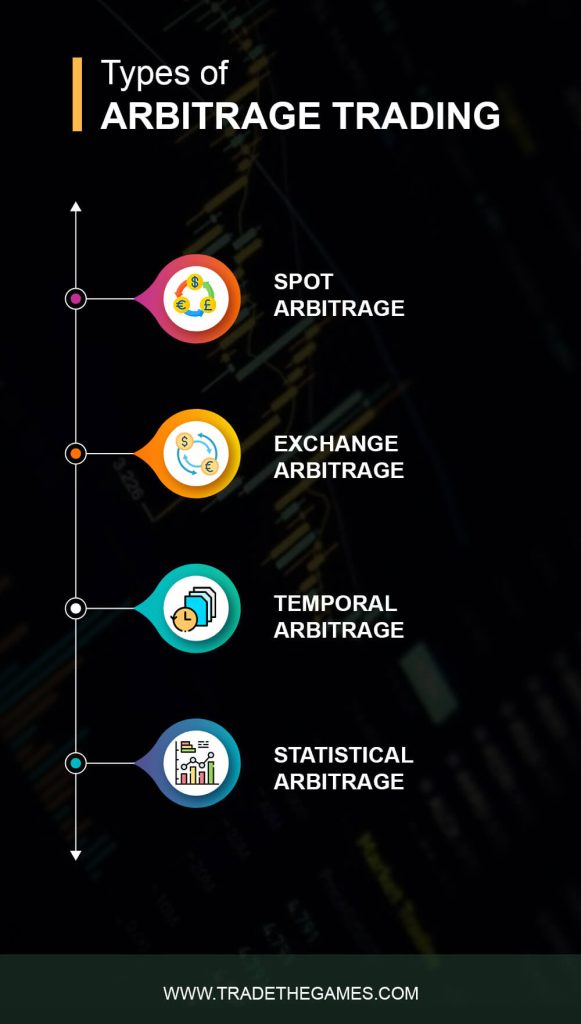

Types of Arbitrage Trading

Crypto arbitrage strategies come in various forms, each catering to different risk appetites and market conditions. Here are four types of crypto arbitrage strategies:

1. Spot Arbitrage

This is the most straightforward form of arbitrage, where traders buy a cryptocurrency on one exchange and simultaneously sell it on another at a higher price. The trader profits from the immediate price difference.

However, it’s essential to consider transaction fees and transfer times, as these can impact the overall gains.

2. Exchange Arbitrage

Exchange arbitrage involves exploiting price differences between various cryptocurrency exchanges. Traders take advantage of these price variations by buying on one exchange and selling on another, often profiting from variations in trading volume and liquidity between platforms.

3. Temporal Arbitrage

Temporal arbitrage takes advantage of price differences that occur over time on the same exchange. Traders buy a cryptocurrency when the price is low and sell it when the price increases. This strategy is a more extended term and relies on predicting price movements based on historical patterns.

4. Statistical Arbitrage

Statistical arbitrage relies on quantitative analysis and statistical models to identify arbitrage opportunities. Traders use historical price data and statistical methods to predict future price movements and execute trades accordingly.

This strategy is more complex and requires advanced analytical skills and trading algorithms.

Each of these arbitrage strategies comes with its own set of risks and rewards, and traders often choose the one that aligns with their expertise and risk tolerance. Additionally, crypto arbitrage trading requires quick execution and an understanding of the market’s dynamics to be profitable.

Is Arbitrage Trading a Risky Affair?

Arbitrage trading, including cryptocurrency arbitrage, carries inherent risks just like any other trading strategy that traders should be aware of. While it can be a profitable endeavour, it’s essential to understand and manage these risks of arbitrage trading effectively.

- Execution Risks: Cryptocurrency markets operate 24/7, and arbitrage opportunities can disappear rapidly. If you’re not able to execute trades quickly, you may miss out on potential profits.

- Transaction Costs: Trading on multiple exchanges may involve fees for buying, selling, and transferring funds. These costs can eat into your profits, and if not considered carefully, you might end up with losses.

- Market Liquidity: Arbitrage opportunities often depend on differences in liquidity between exchanges. In some cases, low-liquidity assets may be difficult to buy or sell without significantly affecting the price.

- Withdrawal and Transfer Times: Transferring funds between exchanges can take time, and this delay can impact your ability to seize arbitrage opportunities effectively.

- Exchange Security: Trusting exchanges with your funds poses security risks. If an exchange experiences a security breach or goes offline, your assets could be at risk.

- Price Volatility: Cryptocurrencies are known for their price volatility. What seems like an arbitrage opportunity could quickly turn into a loss if the market moves against you.

- Regulatory Risks: Cryptocurrency regulations vary globally. Traders must consider the legal and tax implications of their arbitrage activities.

Arbitrage trading, including cryptocurrency arbitrage, can be lucrative, but it’s not without risks. Traders must carefully assess these risks, have a solid strategy in place, and execute trades swiftly to maximize their chances of success. Additionally, staying informed about market conditions and maintaining a risk management strategy is crucial to mitigate potential losses.

How to Enhance Your Crypto Trading Skills?

As the crypto market is highly volatile, it is essential to focus on developing and enhancing your crypto trading skills. Without the trading mechanism, you won’t be able to grab the full potential of the crypto world.

One of the best methods to improve your crypto trading skills is playing crypto fantasy trading games. Such blockchain games offer you a similar environment to a crypto exchange so that you can properly understand the mechanism of the crypto sphere.

Trade the Games is one such play-to-earn game where beginners, as well as experienced crypto traders, can win cash prizes through crypto fantasy trading. On this fantasy trading platform, users can earn in their learning phase without any risk of loss of investment.

So, if you want to indulge in the crypto world with the arbitrage trading strategy, we advise you to download Trade the Games first and become aware of the tactics of efficient crypto trading.